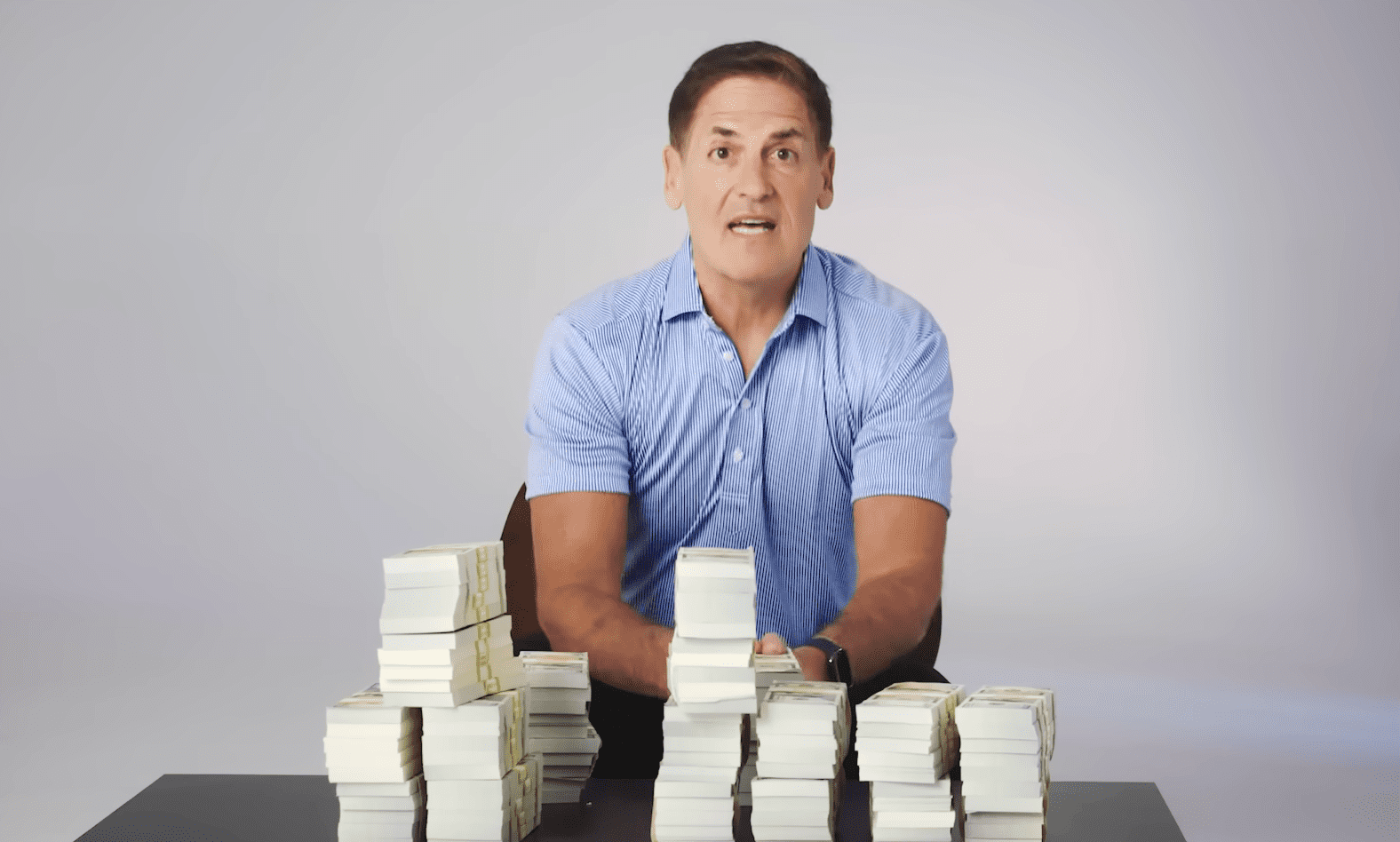

Mark Cuban on how he saved his first billion dollars from wiping out, even after being ridiculed by CNBC on TV

Mark Cuban, the renowned entrepreneur and owner of the Dallas Mavericks, is a testament to the power of perseverance and strategic thinking. His journey to his first billion is a story of innovation, foresight, and resilience, even in the face of ridicule and skepticism.

The Road to a Billion

Cuban’s journey to becoming a billionaire began with the creation of Broadcast.com, an online streaming audio service he built with his friend Todd Wagner. Despite the novelty of streaming sports online in 1995, Cuban saw its potential and invested $10,000 into the venture. His foresight paid off when Yahoo acquired Broadcast.com for a staggering $5.7 billion in 1999, marking Cuban’s entry into the billionaire club.

Facing Skepticism and Mockery

Despite his success, Cuban faced skepticism and mockery from many, including a CNBC journalist over his decisions regarding his Yahoo stocks. After the sale of Broadcast.com, Cuban received 14.6 million shares of Yahoo, valued at roughly $1.4 billion. However, he recognized the tech industry was overheating and feared his stock, which he was legally restricted from selling immediately, would become worthless if Yahoo ran into problems.

Cuban decided to hedge his Yahoo stocks. He worked with Goldman Sachs to craft a “collar” trade, where he bought put options to protect his downside and sold call options to offset the cost of the puts. What it means is that he bought the right to sell his Yahoo shares at $85 if it went below that price. In order to finance buying this ‘right’ he sold other traders the ‘right’ to buy Yahoo shares from him at $205 if the stock blew above that level. This move obviously limited Mark’s potential to profit if Yahoo stock climbed above $205, which it did, going up to $237. His move seemed a bit witless to a lot of people at the time, but Cuban stood by his decision.

Cuban recently revealed in his appearance on Lex Fridman’s podcast that when Yahoo’s stock price kept rising, CNBC TV newscaster Joe Kernen asked Cuban on the show- “Don’t you feel stupid now that Yahoo stock has gone up?”, Cuban’s reply? - “I was like, yeah, I feel real stupid sitting on my jet.”

Proving Them Wrong

Not only did Mark have a clever way of handling mockery but also the foresight to see beyond the temporary rise, which protected his fortune from the eventual fall. When the dot-com bubble burst, many tech stocks, including Yahoo, plummeted, hitting the lowly price of $13 in late 2002. However, Cuban’s strategic move to hedge his stocks paid off. His put options ensured he could sell his Yahoo shares at a “strike price” of $85. That decision saved his fortune and proved his critics wrong.

Mark Cuban had developed a burning desire to maintain the ‘B’ (billionaire) next to his name.

”When we sold to Yahoo, I was like, I’ve got a ‘B’ next to my name. That’s all I need or all I want. I don’t want to be greedy.”

This attitude drove him to make strategic decisions that ultimately led to his success in preserving his wealth and thereafter going on to multiply it with extreme caution at every step.

Conclusion

Mark Cuban’s journey to his first billion and preventing it from wiping out is a story of vision, strategic thinking, and the courage to make unconventional decisions. His ability to withstand mockery and stay true to his convictions serves as an inspiration for aspiring entrepreneurs. As Cuban’s story shows, sometimes the unconventional path, though fraught with challenges and skepticism, can lead to extraordinary success.

You can view the full episode of Lex Fridman’s podcast featuring Mark Cuban here: